Committed Capital

Our five successive funds and affiliated co-investment vehicle have had $2.9 billion in private equity capital commitments, and acquisition capacity of double that amount. Our firm capital commitments allow us to respond to—and close—opportunities more quickly than buyers with less secure sources of capital.

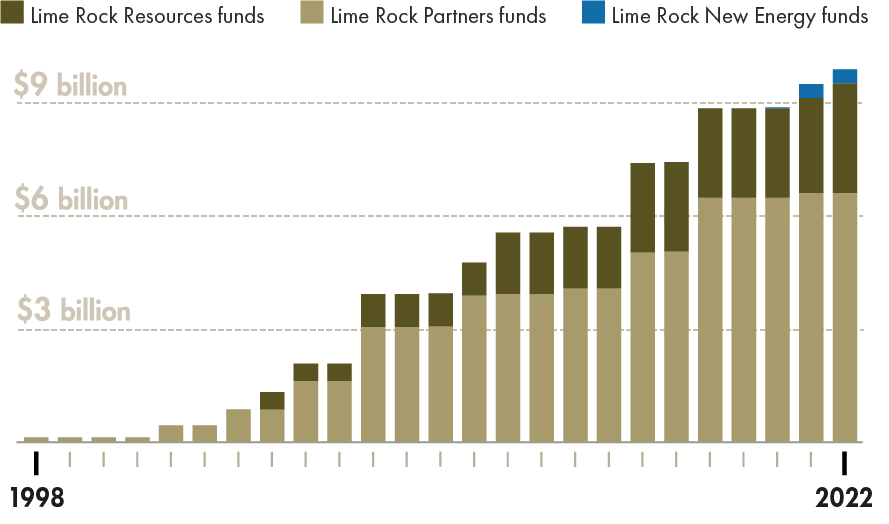

Cumulative Capital Commitments

Since 1998, Lime Rock has raised five Lime Rock Resources funds, eight Lime Rock Partners funds, one Lime Rock New Energy fund, and affiliated co-investment and acquisition fund vehicles.

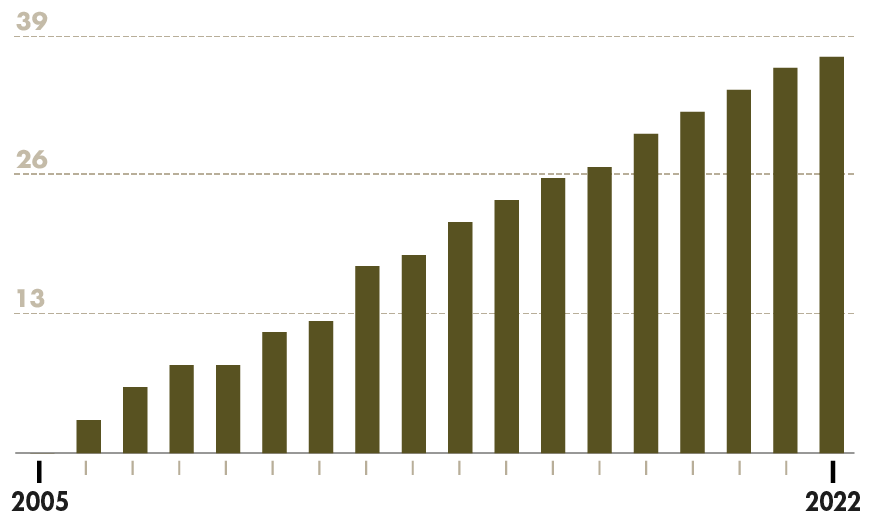

Cumulative Number of Acquisitions Made

Since 2005, the Lime Rock Resources team has steadily made acquisitions in diverse producing oil and gas properties in the United States.

Focused Strategy

Acquiring producing properties in the United States has been our sole strategy since our inception in 2005, and the upstream oil and gas sector has been our business focus our entire careers, through cycles, across almost all basins.

Fast and Responsive

Whether it is letting a seller know promptly if we will be pursuing an opportunity, or working quickly through diligence, structuring, and negotiation phases, we know that your time is as important as ours. Our reputation is built on being a straightforward, responsive counterparty in all transactions.

Creative and Flexible Approach

We want our transactions to be beneficial to both buyers and sellers, and we have consistently deployed a creative and flexible approach to find the structure that works for all parties, including two-part transactions with initial non-operated interests, carve-outs of assets of larger packages, and working interest retained by sellers.

Value Creation through Operations

Our team has an intensive engineering and operations focus on increasing reserves, production, and margins. We buy properties knowing how further value can be unlocked. Through our large operating team and field offices in four states, we can often quickly integrate new properties in our core areas, allowing us to pursue fast-moving transactions.